WASHINGTON — The Federal Reserve just threw cold water on anyone expecting aggressive rate cuts in 2025, and honestly? Your wallet’s about to feel it.

What the Fed Actually Said

In its December 2024 meeting, the Fed cut rates by 25 basis points—no surprise there. But here’s the kicker: they’re now projecting just two rate cuts for 2025, down from the four they signaled back in September. Fed Chair Jerome Powell made it clear that sticky inflation is forcing the central bank to pump the brakes.

“We’re not in a rush to cut rates further,” Powell noted during the press conference. Translation? Don’t expect relief on your mortgage, credit card, or car loan anytime soon.

The Fed’s median projection now calls for 50 basis points of cuts in 2025, compared to the 100 bps markets were pricing in just months ago. And inflation? The Fed upgraded its expectations, seeing elevated price pressures through 2026. So much for that soft landing everyone was hoping for.

Why This Matters

Look, higher-for-longer rates aren’t just a Fed talking point. They hit your actual life. Mortgage rates, which briefly flirted with 6% earlier this year, are likely staying elevated. The 30-year fixed-rate mortgage ended December at around 6.7%, and analysts aren’t seeing much downward movement in 2025.

“The Fed’s hawkish pivot means borrowing costs will remain painful for consumers,” said David Thompson, Chief Economist at Greenfield Capital. Credit card APRs—already averaging north of 20%—will keep crushing anyone carrying a balance. And forget refinancing that auto loan you’ve been eyeing.

But it’s not all doom. If you’ve got cash sitting in high-yield savings accounts or money market funds, those juicy 4-5% yields aren’t going anywhere fast. The flip side? Stocks took a beating in December, with the S&P 500 dropping 2.4% as investors digested the Fed’s message.

What It Means for Readers

So what should you actually do? First, if you’re carrying high-interest debt, prioritize paying it down. Those credit card rates aren’t budging. Second, if you’re shopping for a mortgage, don’t wait for some magical rate drop. Lock in what you can get now—waiting could cost you more.

On the flip side, savers win. Park your emergency fund in a high-yield account and ride those rates while they last. And if you’re investing? Buckle up. Market volatility is likely to stick around as traders recalibrate expectations for 2025.

Bottom line? The Fed’s playing defense against inflation, and we’re all paying the price. Whether it’s your mortgage, credit cards, or retirement account, higher rates mean tighter wallets. Plan accordingly.

Looking Ahead

The Fed’s next meeting is in early 2025, and markets will be watching inflation data like hawks. If price pressures cool faster than expected, the Fed might ease up. But right now? Don’t hold your breath. Powell’s message was crystal clear: they’re prioritizing inflation control over economic growth.

For now, expect rates to stay elevated, borrowing to stay expensive, and savings accounts to keep paying out. It’s not the rate-cut party we were hoping for, but it’s the reality we’re living with.

🔥 Trending Searches in Finance:

🔗 You May Also Like:

- Mortgage Rates Stabilize: What 2026 Holds for Homebuyers

- Amazon and Flipkart push deeper into Indian consumer lending

- Mortgage Rates Stuck in Mid-6% Range: What 2025 Holds

- December Kicks Off Rocky: Markets Drop as Bitcoin Tumbles

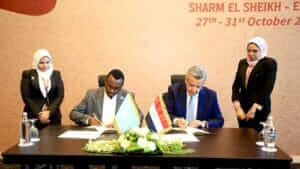

- Somalia and Egypt Sign MoU to Boost Financial Oversight and Anti-Corruption Efforts