WASHINGTON — The Federal Reserve is widely expected to cut interest rates again on December 10, but here’s the twist: mortgage rates aren’t playing along.

As of December 4, the 30-year fixed mortgage rate dropped to 6.19%, down slightly from last week’s 6.23%. That’s good news, right? Well, sort of. A year ago, rates were at 6.69%, so we’ve made progress. But experts say don’t expect big drops anytime soon.

What’s Actually Happening with Interest Rates

Look, the Fed’s current target range sits at 3.75% to 4%, following two quarter-point cuts in September and October. Markets are betting heavily on another cut at the December 9-10 meeting.

But there’s tension behind the scenes. Minutes from the last Federal Open Market Committee meeting show Fed officials are split. Some wanted to hold rates steady in October. Others pushed for cuts. Several emphasized that another 25-basis-point cut in December might not be appropriate.

“Given the Federal Reserve’s recent rate cuts and the anticipation of further reductions in December, it’s reasonable to expect a modest decline in mortgage rates,” says Cameron Burskey, senior partner at Cornerstone Financial Services.

Here’s the thing, though: the Fed’s benchmark rate doesn’t directly control mortgage rates. Those track 10-year Treasury yields, which compete with mortgage-backed securities for investors. And treasuries have been moving in their own direction lately.

The 10-year Treasury yield rose more than 4 basis points to 4.10%, while the 30-year jumped 3 basis points to 4.758%. That’s not what you’d expect if everyone thought rates were headed down.

Why the Disconnect Between Policy and Your Wallet

So why aren’t borrowers feeling relief yet? Simple: banks and lenders are being cautious.

Despite the Fed signaling gradual rate cuts, pricing across the financial landscape is adjusting slowly. Deposit yields remain unusually high. Banks and fintech companies are recalibrating strategies for what they expect will be a prolonged period of cautious easing through 2025 and into 2026.

“I expect mortgage rates to stay around 6.875% to 7.125% in December,” predicts Aaron Gordon, branch manager at Guild Mortgage. “We won’t likely see big moves downward until we see unemployment go up, less government spending, or the Fed jumps back into the mortgage market.”

Melissa Cohn, regional vice president at William Raveis Mortgage, agrees. “Mortgage rates are likely to be stable in December as the markets continue to digest the planned new policies from the President-elect,” she says.

And that’s creating uncertainty. Concerns about potential tariffs and other policies that could spike inflation are making both the Fed and mortgage lenders hesitant to drop rates until they see what actually happens.

What It Means for Borrowers and Homebuyers

Bottom line? Don’t wait for rates to drop dramatically before making your move.

For homebuyers, even small rate changes make a difference. A $400,000 loan at 6.875% instead of 7.125% saves you $67 per month and nearly $25,000 in total interest over the life of the loan. That’s real money.

Plus, there’s a trap nobody talks about: if rates drop and more buyers jump in, home prices will probably surge. You might save on interest but pay way more for the house itself.

“Prospective borrowers should anticipate mortgage rates in the low to mid-6% range through the end of 2024,” Burskey notes. “Significant decreases are unlikely.”

For savers, the picture is mixed. Banks have been slow to drop savings and CD rates even as the Fed cuts. That’s good if you’ve got cash parked, but it won’t last forever.

And there’s another angle: the Fed has actually stopped losing money, according to recent data. Rate cuts halted the central bank’s losses because it’s paying less to banks to maintain the federal funds target rate. That could influence future decisions.

Fintech lenders are being selective, too. They’re focusing on sectors with predictable cash flows — professional services, logistics — while avoiding industries with rising delinquencies like hospitality and discretionary retail.

“The response times of banks and fintech lenders will shape how consumers experience this phase of the rate cycle,” notes financial analyst Dr. Patricia Wong. “Whether easing conditions translate into significantly lower borrowing costs depends on how quickly pricing adjusts.”

The real question is what happens in 2026. Policy changes can occur rapidly, but pricing typically lags. The incoming administration’s relationship with the Fed is still uncertain. Trade policies, tax changes, and government spending could all push inflation higher — or not.

Honestly, rather than hoping for big cuts that might not materialize, focus on what you can control. Shop around for the best rate now. Make sure your credit score is solid. Lock in a decent rate if you find one.

Because here’s what nobody likes to admit: the era of 3% mortgages is probably over. Getting used to 6-7% rates might be the new normal for a while.

🔥 Trending Searches in Finance:

🔗 You May Also Like:

- Fed Signals Fewer Rate Cuts: What It Means for Your Money

- Revolut Tops $75 Billion Valuation as Fintech Giant Eyes Global Expansion

- Mortgage Rates Stuck in Mid-6% Range: What 2025 Holds

- Climate Crisis Costs Surge: $600B in Insurance Losses

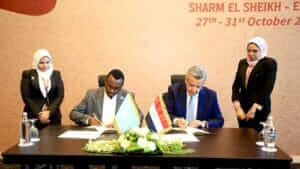

- Somalia and Egypt Sign MoU to Boost Financial Oversight and Anti-Corruption Efforts